Gold tops $4,000 for first time on political, economic worries

Gold topped $4,000 an ounce for the first time Wednesday as investors flocked to the safe investment on worries over the US government shutdown, France's political crisis and global economic uncertainty.

US and European stock markets mostly rose while Asian equities fell as investors also kept tabs on the AI investment boom and the prospect of further US interest rate cuts this year.

Gold, considered a safe investment in times of uncertainty, reached an all-time high above $4,040 an ounce Wednesday. Silver was also close to a record high.

"Gold is continuing to glitter, and it is a gift that keeps on giving," said Fawad Razaqzada, market analyst at City Index and Forex.com.

"Markets hate uncertainty, and right now, it's in no short supply –- although stocks haven't exactly sold off," he added.

"Instead, it is gold that continues to benefit from haven flows while stock markets continue to find buyers on the dips too," he added.

- US political deadlock -

Parts of the US government began to close last week after Democrats and President Donald Trump failed to break a deadlock over spending.

The closure has added to the sense of unease among investors. The release of key economic data, including on jobs, has been postponed -- muddying the waters for the Federal Reserve as it relies on the figures to decide on its rate plans.

Steve Clayton, head of equity funds at Hargreaves Lansdown, noted that the price of gold had doubled over the last two years.

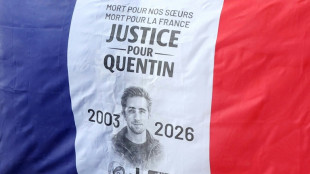

While France's political upheaval has contributed to the gold rush, the Paris stock market was up in afternoon deals on Wednesday.

President Emmanuel Macron is facing the worst domestic crisis of his mandate, with the clock ticking down to a Wednesday evening deadline for a working government to be formed.

Frankfurt's DAX was also higher following mixed economic news.

The German government raised its growth forecast for 2025 from zero to 0.2 percent growth, and its 2026 projection from one to 1.3 percent.

Earlier, however, official data showed a sharp decline in industrial production in August, particularly in the automotive sector.

The euro fell further against the dollar.

In New York, the tech-heavy Nasdaq and the S&P 500 rebounded in early trading after falling the previous day, partly over a report that software firm Oracle's cloud computing profit margin was much lower than expected. The Dow fell.

"Traders seem to consider the shutdown no more than a mild inconvenience due to the postponement of certain economic data releases," said David Morrison, analyst at Trade Nation.

"Instead, investors continue to expect more upside in US equities, supported by ongoing investment in artificial intelligence, along with the prospect of 50 basis-points-worth of rate cuts before the year-end," he said.

Tech firms led selling in Asia, with Alibaba and JD.com down in Hong Kong, chip-maker TSMC dropping in Taipei and Renesas sharply lower in Tokyo.

- Key figures at around 1335 GMT -

New York - Dow: DOWN 0.1 percent at 46,564.89 points

New York - S&P 500: UP 0.1 percent at 6,722.68

New York - Nasdaq Composite: UP 0.3 percent at 22,860.43

London - FTSE 100: UP 0.7 percent at 9,548.51

Paris - CAC 40: UP 0.8 percent at 8,040.61

Frankfurt - DAX: UP 0.7 percent at 24,559.05

Tokyo - Nikkei 225: DOWN 0.5 percent at 47,734.99 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 26,829.46 (close)

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1636 from $1.1652 on Tuesday

Pound/dollar: UP at $1.3426 from $1.3422

Dollar/yen: UP at 152.53 yen from 151.97 yen

Euro/pound: DOWN at 86.67 pence from 86.83 pence

Brent North Sea Crude: UP 0.8 percent at $65.98 per barrel

West Texas Intermediate: UP 0.8 percent at $62.25 per barrel

F.S.Ferrari--INP

London

London

Manchester

Manchester

Glasgow

Glasgow

Dublin

Dublin

Belfast

Belfast

Washington

Washington

Denver

Denver

Atlanta

Atlanta

Dallas

Dallas

Houston Texas

Houston Texas

New Orleans

New Orleans

El Paso

El Paso

Phoenix

Phoenix

Los Angeles

Los Angeles